Sometimes a deposit lands in the wrong account. Or you combined the wrong payments. Or the bank feed auto-categorized something you didn’t mean to accept. Whatever the cause, you’re here to learn how to delete deposit in QuickBooks safely—without wrecking your reconciliations. This step-by-step guide covers QuickBooks Online and QuickBooks Desktop, shows when to delete, when to edit or void, what happens to linked payments, and how to fix bank feed matches afterward. You’ll also get a clean checklist and five concise FAQs.

Before You Delete: Know the Impact

Deleting a deposit removes it from your books. That affects:

- Reconciliations: If the deposit was in a reconciled month, your ending balance will change. You’ll need to re-reconcile or choose a different fix (such as voiding and re-creating).

- Linked payments: Customer payments included in the deposit go back to Undeposited Funds (QuickBooks Online and Desktop). You’ll re-group them into a new, correct deposit.

- Bank feeds: Any matched downloaded transaction will lose its match. You’ll need to undo or re-match it.

Rule of thumb: If the deposit date is in a closed period, consider voiding or entering an adjusting correction instead of deleting.

QuickBooks Online: Delete or Edit a Bank Deposit

Open the deposit the right way

Use one of these paths:

- Gear icon → Chart of accounts → Bank account → View register. Find the Bank Deposit entry, click it, then Edit.

- Reports → Deposit Detail (or Transaction Detail by Account). Click the deposit amount to open it.

Delete the entire deposit

- With the deposit open, scroll to the bottom.

- Click More.

- Choose Delete.

- Confirm.

What happens next: The linked customer payments return to Undeposited Funds. Any free-form “Other funds to deposit” lines are removed and would need to be re-entered if still needed.

Remove only certain payments from a deposit

If most of the deposit is right and a line or two is wrong:

- Open the deposit.

- In the Selected payments area, use the trash can icon on the incorrect line(s) or remove manual lines from Other funds to deposit.

- Save and close.

Removed customer payments go back to Undeposited Funds so you can deposit them correctly.

Fix the bank feed match after changes

- Go to Banking/Transactions → Categorized.

- Find the downloaded bank entry that was matched to the now-deleted or edited deposit.

- Click Undo to send it back to For review.

- Re-match it to the corrected deposit or Add it properly.

Tip: Use the Audit Log

- Gear icon → Audit log.

- Filter by Users/Date and Events = Transactions to see who changed or deleted a deposit and the original details, so you can recreate it accurately.

QuickBooks Desktop (Pro, Premier, Enterprise): Delete or Void a Deposit

Open the deposit

Two easy routes:

- Banking → Make Deposits. If the Payments to Deposit window appears, click Cancel. In the Make Deposits window, use Previous/Next to find the deposit.

- Lists → Chart of Accounts → Double-click your bank account to open the register, then double-click the deposit.

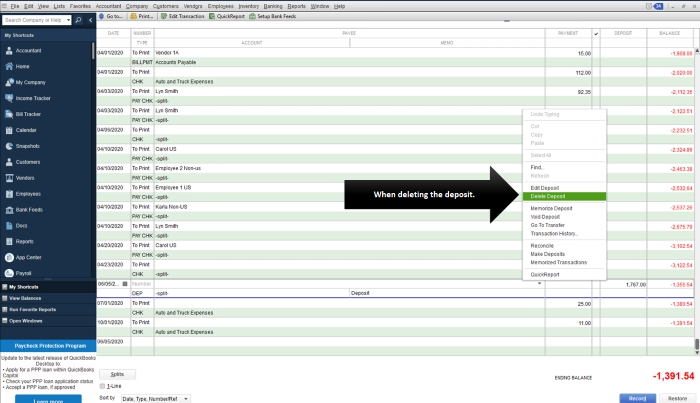

Delete the deposit

- In the Make Deposits window: Edit → Delete Deposit.

- Or, in the bank register: Right-click the deposit → Delete Deposit.

Void instead of delete (closed periods)

- Edit → Void Deposit. Voiding keeps a zeroed placeholder on the original date, which preserves reconciliation history. Then create a corrected deposit.

After deletion/void: Customer payments return to Undeposited Funds. Rebuild the deposit with Banking → Make Deposits and select the proper payments.

Choosing the Right Fix: Delete vs. Edit vs. Void

Use this decision map:

- Wrong customer payments grouped together, same period still open:

Edit the deposit to remove incorrect lines, or delete and rebuild.

- Deposit in a reconciled/closed month but amount was wrong:

Void on the original date, then re-create correctly in the same period. If the period is locked with a closing date/password, consult your accountant before changing.

- Bank feed created a duplicate deposit:

Delete the duplicate deposit in QuickBooks. Then, in bank feeds, Undo the match if needed and Exclude any duplicate downloaded entry you won’t use.

- Daily merchant service batch posted with the wrong mapping:

Delete or edit the deposit, then re-group payments from Undeposited Funds with the proper income or clearing accounts.

What Happens to Linked Items When You Delete

- Customer payments (Receive Payment/Sales Receipts): They move back to Undeposited Funds. Invoices remain paid; you’re just re-depositing the funds grouping.

- Manual lines (“Other funds to deposit”): These do not return anywhere; they’re simply removed. Re-enter them if still required.

- Matches in Banking: The link breaks. Redo the match to the corrected deposit.

- Reconciliation status: If deleted in a reconciled month, the transaction is gone and your last reconciliation will show a difference equal to that deposit. Re-reconcile after fixing.

Step-by-Step: Rebuild a Correct Deposit (Online & Desktop)

- Open the Deposit form

- Online: + New → Bank Deposit.

- Desktop: Banking → Make Deposits.

- Online: + New → Bank Deposit.

- Select the right bank account and date

Match your actual bank statement date.

- Choose payments

Tick only the customer payments that truly appeared together at the bank. If you received two checks on Friday but deposited one on Monday and one on Tuesday, build two deposits.

- Add other funds (if any)

Use Add funds to this deposit for items like reimbursements, owner contributions, or merchant fee adjustments. Choose the correct Account for each line.

- Save

Review the total against your bank statement or the downloaded bank line. Save and, if in QBO, match to the feed.

How to Handle Deposits in the Bank Feed

- If a downloaded transaction represents a real bank deposit, try to Match it to an existing deposit you just rebuilt.

- If QuickBooks suggests a duplicate (because you accidentally added one earlier), Undo the categorized entry, then Exclude the duplicate.

- If the bank feed entry is actually multiple payments batched together, create or edit a single deposit that groups them exactly, then Match once totals align.

Keeping the bank feed in sync prevents the same error from resurfacing during reconciliation.

Common Scenarios and Exact Fixes

You used “Add” on a bank feed and created a deposit to the wrong income account

- Find the deposit, Edit, and fix the Accounts on the “Other funds to deposit” lines.

- If the deposit also included customer payments, verify those still map to Undeposited Funds in the top section.

You accidentally deposited to the wrong bank account

- Open the deposit and change the Deposit To account to the correct bank.

- If the month is reconciled, consider void and re-create to keep reconciliation history intact.

The total is right, but a customer payment is missing

- Open the deposit and add the missing payment (it must still be in Undeposited Funds). If it isn’t there, the payment may have been deposited elsewhere—find and edit that other deposit first.

The bank feed shows one line, but you made two separate deposits in QuickBooks

- If the actual bank combined them, delete the two book deposits and rebuild one that matches the bank total, then Match to the feed.

Deposit was part of last month’s reconciliation

- Prefer Void on the original date and then re-create properly on the same date. Re-open the reconciliation and confirm it still ties out.

Controls that Keep Deposits Clean

- Undeposited Funds first: Always receive payments into Undeposited Funds, then group them intentionally using Bank Deposit.

- Daily routine: Reconcile downloaded bank deposits each day so mismatches are caught early.

- Closing date: Set a closing date with a password (Accountant tools in QBO) to prevent casual changes to closed periods.

- Audit log reviews: Check the log weekly if you have multiple users touching deposits.

- Use reports: Deposit Detail and Reconciliation Discrepancy reports quickly surface issues.

A Simple Checklist You Can Repeat

- Open the deposit from the register or report.

- Decide: Edit, Delete, or Void based on period status.

- If deleted or edited, ensure payments returned to Undeposited Funds.

- Rebuild the deposit with correct payments, date, bank, and any “Other funds” lines.

- Fix the bank feed: Undo old matches, then Match to the corrected deposit.

- Re-reconcile if the change touched a closed month.

- Document in Memo and, if needed, in your audit log notes.

FAQs

Can I restore a deleted deposit?

There’s no one-click restore. Use the Audit Log (Online) or your memory/report trail (Desktop) to view details and re-create the deposit exactly.

What’s the difference between voiding and deleting?

Delete removes the transaction entirely. Void leaves a zero-amount shell on the original date, preserving reconciliation context—useful for closed periods.

Do customer invoices become unpaid if I delete a deposit?

No. The payments remain applied to invoices. They simply move back to Undeposited Funds so you can group them into a new deposit.

How do I handle merchant service batch deposits that were grouped wrong?

Delete or edit the batch deposit, then re-create the grouping from Undeposited Funds to match the actual bank batch. Finally, Match the bank feed item.

I deleted a reconciled deposit and now my reconciliation is off. What now?

Rebuild the correct deposit on the same date, then re-open last month’s reconciliation to verify the difference is eliminated. If the period is locked, coordinate with your accountant.